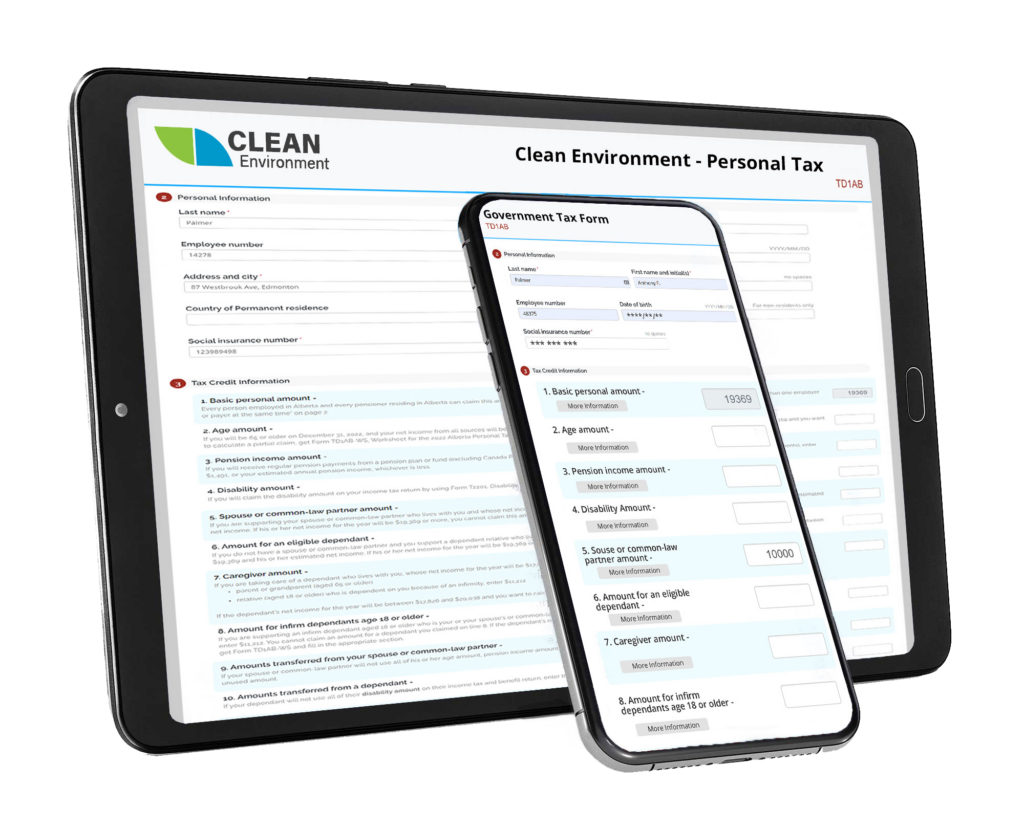

Simplifying Employee Tax Forms with Software

Canadian employee tax forms have become more and more complex over the years which has necessitated the use of software to streamline the whole process. Enterprises were the first to adopt software for employee tax purposes but now small, large, and every company in between are using digital forms and software to automate and streamline as much of the employee tax process as possible. Today we鈥檒l discuss how to save time, paper, and energy when filing employee taxes with software.

Explore this Article:

- Choosing the Right Employee Tax Software

- Embracing Efficiency: The Digital Impact on HR Professionals

- Seamless Integration: A Step-by-Step Guide to Implementing Employee Tax Form Software

- Maximizing Returns: Employee Tax Form Software in Action

- Elevating HR Management: Success Stories and Continuous Improvement with Employee Tax Form Software

The Shift to Digital Efficiency

The transition from paper-based to digital processes has been a game-changer in HR, offering a host of benefits. Adopting software for employee tax forms can significantly improve accuracy, save time, and reduce the burden on HR professionals.

Understanding the Landscape

Before diving into the specifics of how software can revolutionize your approach to employee tax forms, let’s briefly explore the current landscape. are as varied as the landscapes that stretch from the Atlantic to the Pacific. Navigating these regulations can be a daunting task, particularly when dealing with the multitude of forms required for each employee.

The Challenge of Traditional Methods

Traditionally, HR professionals have grappled with the manual compilation of T4s, T4As, and other tax-related forms. The meticulous process of gathering data, performing calculations, and ensuring compliance with ever-evolving tax laws can be time-consuming and error-prone.

Enter Software Solutions

The right software can automate calculations, ensure compliance, and provide a centralized platform for managing and distributing forms.

Choosing the Right Employee Tax Digital Forms or Software

When it comes to selecting the right digital form software or templates for Canadian employee tax forms, it’s essential to understand the features that will best serve your needs. Your software should address the unique challenges posed by employee tax forms.

1. Seamless Integration with Existing Systems

Much like the harmony achieved when various tools in a toolbox complement each other, your chosen software should seamlessly integrate with your existing HR systems. This integration ensures a smooth flow of data, reducing the risk of errors and saving valuable time. Imagine the efficiency of having all employee tax form data accessible in one centralized location.

2. Automation for Accuracy

The beauty of using software for employee tax forms lies in its ability to automate complex calculations. Just as a well-calibrated machine can perform intricate tasks with precision, the right software can handle tax calculations accurately and efficiently. This not only minimizes the chances of errors but also frees up HR professionals to focus on more strategic aspects of their role.

3. Compliance at Your Fingertips

Tax regulations are ever evolving, and compliance is non-negotiable. The right software should act as a compliance compass, keeping you on the right path amidst the intricate maze of tax laws. By regularly updating its features in line with legislative changes, the software becomes your ally in ensuring that employee tax forms meet all necessary regulatory requirements.

4. User-Friendly Interface

Just as a toolbox with well-organized compartments makes finding the right tool a breeze, your software should boast an intuitive, user-friendly interface. Navigating through the system should be as straightforward as locating a tool in a well-arranged toolbox. This ensures that your team can quickly adapt to the new system, minimizing the learning curve and maximizing efficiency.

5. Customization for Individual Needs

Every workplace has its nuances, much like different job sites requiring specific tools. Your chosen software should be customizable to accommodate the unique needs of your organization. Whether it’s tailoring the system to handle specific data points or generating custom reports, flexibility is key to optimizing the software’s utility for your HR team.

6. Making Your Onboarding Easy

Embracing digital forms for employee tax documents is a pivotal step in modernizing onboarding processes, significantly streamlining what was once a cumbersome administrative task. According to a recent survey conducted by HR Tech Insights, organizations that transitioned to digital tax document forms reported a staggering 40% reduction in onboarding time. This digital shift expedites the collection of crucial tax-related information, minimizes errors associated with manual data entry, and ensures a smoother onboarding experience for both HR professionals and new hires. The efficiency gains not only save time but also contribute to a positive first impression, setting the tone for an employee-centric onboarding journey. Furthermore, companies that used the forms integrated in a purpose-built onboarding application cut even more time and costs in the process.

Embracing Efficiency: The Digital Impact on HR Professionals

Now that we’ve unpacked the essential features to look for in employee tax form software, let’s delve into the transformative impact it can have on HR professionals and the overall management of these crucial documents.

1. Liberating HR Professionals from Tedious Tasks

Just as automated machinery liberates workers from repetitive tasks, software liberates HR professionals from the tedious aspects of manual tax form management. With calculations and compliance checks handled automatically, your team can redirect their energy towards more strategic HR initiatives, fostering professional growth and innovation.

2. Accuracy as the Cornerstone of Compliance

Ensuring accuracy in employee tax forms is not just about avoiding errors; it’s about upholding compliance with tax laws. The software acts as a vigilant guardian, consistently applying the latest regulations to the data it processes. This reliability becomes the cornerstone of compliance, mitigating the risk of costly errors and legal repercussions.

3. Time Savings Leading to Increased Productivity

In a world where time is of the essence, the efficiency gained through software translates directly into time savings. HR professionals can allocate their time more strategically, focusing on tasks that demand human insight and creativity. Just as a well-organized toolbox saves time searching for tools, streamlined software saves time in managing employee tax forms, contributing to increased overall productivity.

4. Enhanced Data Security and Confidentiality

Much like a toolbox keeps valuable tools secure, employee tax form software prioritizes data security. Confidential employee information is safeguarded through encryption and secure access controls, reducing the risk of unauthorized access or data breaches. This commitment to data security ensures that sensitive information remains confidential and protected.

5. Adapting to the Future of HR Management

Just as innovative tools pave the way for the future of construction or any industry, embracing employee tax form software positions your HR department at the forefront of digital HR management. The ability to adapt to technological advancements in HR is increasingly becoming a competitive advantage. This software not only meets current needs but also positions your organization for future advancements in HR practices.

Seamless Integration: A Step-by-Step Guide to Implementing Employee Tax Form Software

Now that we’ve identified the essential features of employee tax form software, let’s embark on the journey of implementing this transformative tool into your HR infrastructure. Just as introducing a new tool into a well-organized toolbox enhances its capabilities, the integration of software should elevate, not disrupt, your workflow.

1. Assess Your Current System and Needs

Before diving into implementation, conduct a comprehensive assessment of your current HR systems and processes. What are the pain points in your current approach to managing employee tax forms? Identify specific challenges, whether they involve data organization, compliance concerns, or time-consuming manual calculations. This diagnostic phase sets the stage for selecting a software solution tailored to your organization’s unique needs.

2. Selecting the Right Software

Armed with insights from your assessment, it’s time to choose the software that aligns with your HR objectives. Look for a solution that not only addresses your identified challenges but also integrates seamlessly with your existing HR systems. Consider factors such as user-friendliness, customization options, and ongoing support. Just as a skilled craftsman selects the right tool for the job, choose software that is not only powerful but also fits harmoniously into your HR toolkit.

3. Conducting Training Sessions

Introducing new tools to a team requires training, and the same applies to implementing employee tax form software. Develop a training program that ensures your HR professionals are well-versed in the software’s features and functionalities. This step is crucial for minimizing resistance to change and maximizing the software’s potential. A well-trained team ensures that the transition is smooth, and the benefits of the software are fully realized.

4. Phased Implementation for Minimal Disruption

Rolling out the software in phases minimizes disruption to your HR processes. Start with a pilot group to iron out any unforeseen issues and gather feedback. This phased approach allows your team to gradually adapt to the new system, ensuring that everyone is on board before full-scale implementation. Just as a craftsman introduces a new tool gradually, a phased implementation strategy allows your team to acclimate to the software without overwhelming them.

5. Monitor and Fine-Tune

The integration process doesn’t end with the initial implementation. Regularly monitor the software’s performance, gather feedback from your HR professionals, and be open to making adjustments. Continuous improvement is the key to optimizing the software’s benefits. Just as a well-maintained tool functions better and lasts longer, ongoing monitoring and fine-tuning ensure that the employee tax form software remains a valuable asset in your HR toolkit.

Maximizing Returns: Employee Tax Form Software in Action

With the software seamlessly integrated into your HR processes, let’s explore how it transforms the handling of employee tax forms, delivering tangible benefits to your organization.

1. Swift and Error-Free Calculations

Bid farewell to manual calculations and the risk of human error. The software automates complex tax calculations, ensuring accuracy and compliance with the latest tax regulations. This not only saves time but also provides peace of mind, knowing that your calculations are precise and error-free.

2. Centralized Data Management

Imagine a toolbox where each tool has its designated place for easy access. Similarly, the software centralizes all employee tax form data, making it easily accessible and manageable. This centralized approach enhances organization, reduces the risk of data silos, and simplifies the retrieval of information during audits or reporting.

3. Real-Time Compliance Updates

Tax laws are dynamic, and compliance is a moving target. Employee tax form software keeps you on the right side of compliance by providing real-time updates. Automatic updates ensure that the software aligns with the latest legislative changes, reducing the risk of non-compliance and associated penalties.

4. Enhanced Employee Experience

Just as a well-maintained tool enhances a craftsman’s work, the software contributes to an improved employee experience. Employees receive accurate and timely tax forms, fostering transparency and trust. This positive experience contributes to overall employee satisfaction and engagement.

5. Strategic Allocation of HR Resources

With routine tasks automated, HR professionals can redirect their efforts toward strategic initiatives. This newfound capacity for strategic thinking positions your HR team as a value-driven asset within the organization. As your team focuses on high-impact activities, the software continues to handle routine tasks with efficiency.

Elevating HR Management: Success Stories and Continuous Improvement with Employee Tax Form Software

As we conclude our exploration into the transformative realm of employee tax form software, let’s delve into real-world success stories, anticipate potential challenges, and outline strategies for continuous improvement. Just as a seasoned craftsman refines their skills over time, your journey with employee tax form software is an ongoing commitment to efficiency and excellence in HR management.

Success Stories: Realizing the Potential

Numerous organizations have embraced employee tax form software and experienced remarkable success. By integrating this tool into their HR toolkit, these companies have streamlined processes, reduced errors, and elevated the overall efficiency of their HR functions. The seamless automation of tax calculations and compliance updates has not only saved time but also positioned HR as a strategic partner within the organization. These success stories underscore the transformative power of leveraging technology to manage employee tax forms effectively.

Challenges and Solutions: Navigating the Path to Success

While the benefits of employee tax form software are evident, challenges may arise during the implementation and utilization phases. Common hurdles include resistance to change, potential system integration issues, and the need for ongoing training. Recognizing these challenges is the first step toward overcoming them. A proactive approach, coupled with open communication and continuous training, can address these issues and ensure a smoother transition. Like any tool in a craftsman’s kit, occasional maintenance and adjustments are part of the process to keep everything running seamlessly.

Continuous Improvement: A Blueprint for Excellence

Just as a craftsman consistently sharpens their tools, your commitment to excellence in HR management requires continuous improvement. Regularly assess the performance of your employee tax form software, gather feedback from users, and stay informed about advancements in HR technology. This ongoing commitment ensures that your organization remains at the forefront of efficient HR practices, adapting to changes in tax regulations and leveraging new features that enhance overall effectiveness.

Employee Tax Forms in Tomorrow’s HR Landscape

As we look ahead, the role of employee tax form software in HR management will continue to evolve. Technological advancements, changes in regulatory frameworks, and the ever-shifting landscape of the workforce will influence the development of these tools. Staying informed about emerging trends and being agile in adopting new features will be paramount. Employee tax forms, once a burdensome administrative task, will evolve into a strategic element of HR management, contributing to employee satisfaction, compliance, and overall organizational success.

Conclusion: A Toolkit for the Future

In conclusion, the integration of employee tax form software into your HR toolkit is not just a modernization effort; it’s an investment in the future of HR management. Much like a craftsman’s toolkit evolves with innovative tools, your HR toolkit should adapt to the changing demands of the industry. By embracing technology, fostering a culture of continuous improvement, and sharing in the success stories of organizations that have transformed their HR processes, you are equipped to navigate the complexities of employee tax forms in the ever-evolving landscape of HR management. As you embark on this journey, remember that you are not merely adopting a tool; you are shaping the future of HR excellence. Here’s to a future where managing employee tax forms is not a task but a strategic advantage, propelling your organization toward greater efficiency and success.